Last week, I challenged myself (and anyone interested) to create or reconsider my budget and start thinking about the categories we can begin trimming down. Additionally, I wanted to look at my discretionary spending and using an envelope or jar system to keep us on track.

This week we’re going to be looking at the jars in more depth, as well as introducing the idea of ‘sinking funds’ (or a Freedom Account with Debt Proof Living) to help us prepare for future expenses.

Jar/Envelope Spending Plans

The biggest benefit of a jar or envelope system is that it helps us tangibly see how much we are spending in each category, and if we are diligent, keep us to our budgeted amounts. Often when we are using debit cards for our spending (or worse yet, credit cards) it’s not until we check our online balance or get the statement at the end of the month that we see how all of the little expenses add up and we’ve somehow found ourselves over budget (and into the overdraft!).

How do you best start creating a system like this? The two systems are very similar, but we’ll look at the jar system in this post because it is more of a visual reminder and we can make pretty labels for the jars. :)

Remember that budget you worked on last week? What were the amounts that you budgeted for based on your monthly averages? Discretionary spending includes expenses such as groceries, gas for your car or transportation, entertainment and dining, and personal care (haircuts, manicures, etc.). Print off some of the labels below on label paper (Avery 5162), or print it on plain paper, cut out and tape to mason jars (or attach to the front of envelopes if you’re going that route!). You can also make your own labels for the jars if you’d like.

There’s space on the labels for you to write the category and the monthly amount. Save and print off new labels whenever you’ve adjusted your budget!

Next, you need to figure out how you’re going to track your spending in each of the categories. If you live on your own you could just put the receipts in the jar and spend until the money is gone, but if you are budgeting with a spouse or partner and need to share the money in the jar, some sort of tracking system is necessary. It is also helpful for accountability and to see that you spent most of your grocery budget at Starbucks on Pumpkin Spice Lattes (almost a forgivable offense!).

I’ve created some pages for you to print out and put in a half size binder. You could also just print and cut a stack of them and staple them together. Do whatever ensures that you will use it!

Below is an example of how to write down your expenses on each sheet. Create one sheet for each category of spending and be sure to use them weekly at first. After you’ve gotten used to it, you can change it to correspond to your pay period (more forms to come!).

| Expense: Groceries | Weekly $: 75.00 | ||

| $75.00 | |||

| 1-Oct | Metro | $11.15 | $63.85 |

| 1-Oct | Tim Hortons | $1.45 | $62.40 |

| 2-Oct | Loblaws | $33.47 | $28.93 |

| 4-Oct | Metro | $26.82 | $2.11 |

| 4-Oct | Tim Hortons | $1.45 | $.66 |

| | | | |

| | | | |

Think you can make that work? Give it a try!

Sinking Funds

Next, is the concept of sinking funds, which are basically monies saved up to cover the inevitable expenses incurred when you need to buy a new washer or stove, go on vacation, buy gifts for Christmas, birthdays or weddings, or simply just to save up for all of your home decor projects. The idea is two-fold. First, we live in an instant gratification society and we’ve developed the attitude that if we see something we want, we should buy it right away, even if we don’t have the funds to cover it. Sinking funds require patience; each paycheque you put more and more aside and slowly build up towards your idea balances. Second, instead of putting sudden expenses on a credit card, we have our own savings to use in its place.

What kind of expenses are most typical for sinking funds? For our own funds, we are at various times, funding accounts for: auto expenses, home expenses, gifts, vacations, and baby expenses. Consider everything in a year that you KNOW will come up, but that aren’t necessarily monthly expenses. Oil changes, chimney sweeping, weekend getaways and a gift for your cousin’s wedding are all things you probably know quite in advance that you’ll need to pay for, but often we leave it to the last minute and have to pull money from somewhere else to cover it.

Steps to creating sinking funds:

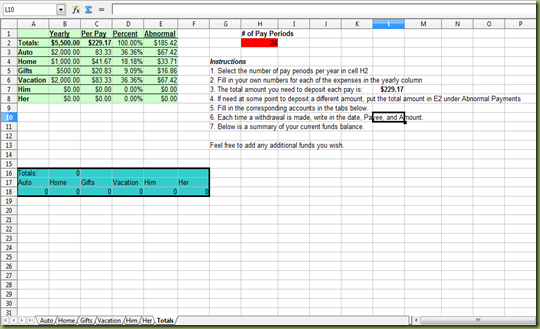

1. Decide how much you need yearly to cover your expenses in each of the categories. The amounts in the spreadsheet below are the amounts Craig and I have assigned to each category, but it should be based on the kinds of expenses you’ve paid in the past.

2. Divide that yearly amount by the number of pays you have per year, and this is the amount you need to be setting aside each time to help cover your expenses.

3. Open an account to cover these expenses. No fee bank accounts such as ING are great for this purpose; you can even open an account for each category, although I would find that more complicating.

4. Make it automatic. Set up an automatic transfer that takes place after you’ve been paid each time so that you don’t even have to think about it.

5. Starting using the accounts to cover your abnormal expenses. You won’t be able to buy that washer or stove right away, but you’ve been buying things on credit for years, this kind of savings takes time!

Here’s the document that I use to track our sinking funds. We have a single bank account to hold all of the funds, set as ‘savings’ on our debit cards so that we can access the funds if we need to at the store.

Important to consider:

- You’re probably never going to have the total yearly amounts in the accounts, but that’s the idea. It is a sinking fund because the funds are constantly in use.

-If the accounts do reach their maximum (say you haven’t used the gift or vacation accounts for a while), you can stop funding them until they dip below their maximum again. Similar to a debt snowball (more next week), redirecting the funds will help fund them all faster and move you towards other savings goals.

- If you have a major windfall and have a. paid of debts, and b. fully funded an emergency fund, fully funding your sinking funds can be a great investment so that you can move the funds into your retirement savings or generous giving until you’ve needed to use some of the sinking fund money.

- Create new accounts for all of your goals. Want a new boat or car? Create an account and assign a monthly or yearly amount to start saving!

This week’s challenge:

Perfect your jar or envelope system (try it for a month and see if it makes a difference in the amount you’re spending and your ability to follow the budget) and set up a sinking funds account at your bank of choice. Use the document I provided or your own creation to begin tracking the debits and credits of each individual account.

1 comment:

Great post. I need to plan better for sinking funds. Ugh! Wanted to say how great it is to find your blog. My husband and I were both military brats.Our fathers were in the Canadian Forces, his airforce and mine army(YAY!).Can't wait to read back through your posts.

Post a Comment